Investors in LJIP shall enjoy the following tax incentive policy:

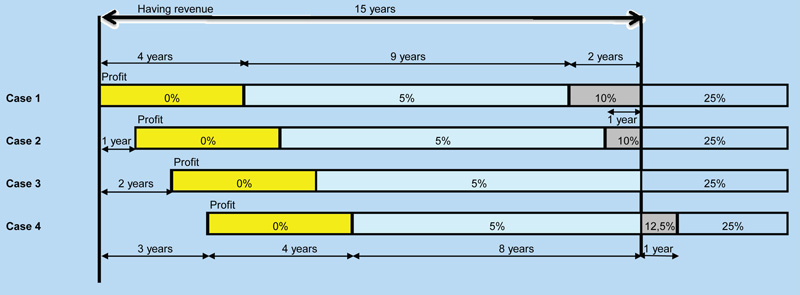

- 15 year preferential period for enterprise income tax of 10% since having revenue, including 4 years of tax exemption from the first profit-making year, 9 subsequent years with tax rate discount by 50%.

- 5 year exemption of import tax since operation for the cases of importing raw materials, materials and semifinished products, which have not been produced in Vietnam.

- Exemption of import tax when importing machines to form fixed assets, including equipments, machines, transportation means specially used in technology lines confirmed by the Ministry of Science and Technology, means of transporting workers including automobiles from 24 seats or more, waterway equipments, construction materials, which are not yet manufactured locally.

- EPZ enterprises in Long Jiang IP shall enjoy the preferential tax policies in accordance with the regulation of export processing zone.

According to:

- Decree No.108/2006/NĐ-CP dated 22/9/2006

- Decree No.87/2010/NĐ-CP dated 13/8/2010

- Circular No. 194/2010/TT-BTC dated 06/12/2010

- Circular No.02/2007/TT-BTM, dated 2/2/2007

Following is the demonstration of 4 cases of enterprise income tax preferential treatment: